Real estate investment is getting popular among investors since the past 50 years. Real estate is a good investment vehicle to diversify your investment portfolio. However, it is not only about finding the perfect property and getting a mortgage loan to invest in the property. Despite the property price, you have to be aware of the purchasing costs and get the money prepared before you make such a huge decision!

There are two ways to buy a property in Malaysia. First, buying a new property from developers. Second, buying a sub-sale property in the secondary market. If you are buying newly launched property, you might be able to enjoy some discounts and rebate from developers, which can reduce your purchasing costs. However, when it comes to sub-sale property, many unavoidable costs are involved.

If you are buying a property that costs RM 400,000, do you know how much roughly would you have to prepare in cash? Let’s take a look at the costs involved!

1. Down payment

The maximum amount of financing that a bank in Malaysia can provide is 90% of the property price. This means that you would have to prepare at least 10% of the property price for down payment.

Down payment

= RM 400,000 X 10%

= RM 40,000

2. Sale and purchase agreement fees

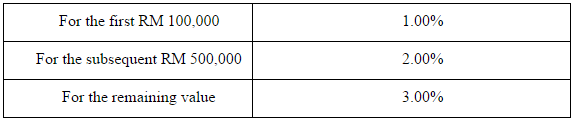

SPA fees involve professional legal fee, stamp duty and disbursement fee. For professional legal fee starting from 15 March 2017, the calculation is as follows:

= RM 400,000 X 1.00%

= RM 4,000

In a meanwhile, for property stamp duty, the calculation is as follows:

= RM 100,000 X 1.00% + RM 300,000 X 2.00%

= RM 7,000

Bear in mind that the professional legal fee is subject to 6% government tax and the disbursement fee is estimated to be in the range of RM 1,000 to RM 1,500.

Sales and purchase agreement fees

= RM 4,000 X 1.06 + RM 7,000 + RM 1,000

= RM 12,240

3. Loan agreement fees

Loan agreement fees also involve professional legal fee, stamp duty and disbursement fee. Other than property stamp duty, the charges for other fees are the same as SPA fees. For the property stamp duty, 0.50% will be charged on the total loan amount. Please take note that sometimes these fees can be financed into the loan, but a higher interest rate will be applied.

Professional legal fee

= RM 360,000 X 1.00%

= RM 3,600

Property stamp duty

= RM 360,000 X 0.50%

= RM 1,800

Loan agreement fees

= RM 3,600 X 1.06 + RM 1,800 + RM 1,000

= RM 6,616

4. Valuation fee

A formal valuation report has to be submitted to the financing bank if you are going to purchase a sub-sale property. The valuation fee costs about 0.30% of the property price.

Valuation fee

= RM 400,000 X 0.30%

= RM 1,200

5. Bank processing fee

Usually the bank will charge a one-time fee as the processing fee for your loan application. The bank processing fee varies according to different banks, which ranges from RM 100 to RM 200.

Bank processing fee

= RM 100

Based on the calculations above, it is estimated that the purchasing cost needed to be prepared in order to buy a property costs about RM 400,000 is:

Purchasing cost

= RM 40,000 + RM 12,240 + RM 6,616 + RM 1,200 + RM 100

= RM 60,156* (15% of the property price)

*The cost is only a rough estimation.

In conclusion, you would have to prepare about 15% to 20% of the property price in cash before you start your house hunting!

For more inquiries regarding the purchasing cost, please do not hesitate to contact us.

If you have any questions or would like to arrange a viewing, please feel free to contact us!