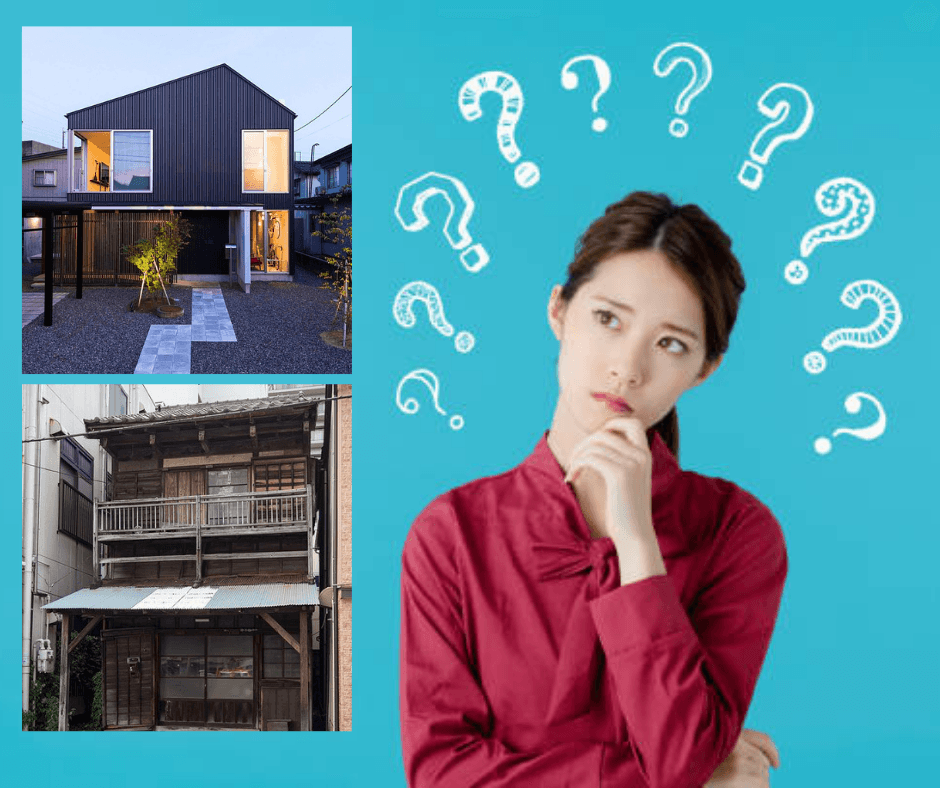

Are you deciding between purchasing a new or used property?

Newly-built properties are more popular than used properties in the Tokyo Metropolitan Area, but you need to carefully choose which kind of property best fits your preferences.

Price and Facilities

The most conspicuous features of newly-built properties are that they are “new” and “clean.” Because the property is unused, there tends to be a high number of interested buyers. The cost, however, is much higher because new properties’ prices include an advertisement fee. Moreover, the range of drop of asset value is wider compared to a used property.

Preferential System

There is a reduction of tax policy for newly-built properties:

・Fixed Asset Tax

The tax rate is usually 1.4% of the assessed value of fixed assets, while the tax of a newly-built condominium is reduced to half of that value.

・Registration and License Tax

The tax rate of a new property is 0.15% of the assessed value of fixed assets, whereas a used property’s tax rate is 0.3% of the assessed value.

・Real Estate Acquisition Tax

The tax rate of newly-built property is:(Assessed value of fixed assets-12,000,000 yen) × 3%.

The used property deduction depends on the number of years of the buildings’ construction as follows: (Assessed value of fixed assets - Deduction) × 3%.

Furthermore, dealers are obliged to take responsibility for any defects of a property for ten years. In contrast, used property is usually not insured and, in the event, the sellers has to take responsibility for only for two to five years.

Different Cost

The cost you have to pay varies depending on new property or used property to buy.

Buying a used property requires paying a commission fee about 3% of the price of a property.

On the other hand, a newly-built property cost you about 200,000 yen to 300,000 yen for reserve fund for repairs.

Loans

There are many conditions to apply for a loan in purchasing a used property.

For example, the years of the building has to be under 25 years or it must comply with the earthquake-proof standard. Additionally, the life of the loan needs to be over 10 years, and the required floor space is over 50㎡.

Finding Property

You can choose the location you want if you choose an used-property, but it might be difficult to find new properties in the area you want. Also, if you purchase a used-property, you can move in as soon as possible, but if you purchase a newly-built property, you need to wait until its completion. On the contrary, newly-built property may provide you with more modern facilities.

Because a used building already exists, you can imagine what the life in the property is like. Although you can renovate used properties to your preference, you are able to see new properties’ construction process and customize the building and its facility to your ideal.

Last but not least, it may be best to choose a property that is earthquake resistant. It is not always assumed that a newly-built property is safe with the latest earthquake resistant qualities. In 1981, the Building Standard Act was implemented and prescribes more strict criteria for earthquake resistance of houses. Thus, most of the buildings constructed after 1981 usually have the same level of earthquake resistance.

If you have any questions or would like to arrange a viewing, please feel free to contact us!